Looking at these numbers as raw data would indicate that the company experienced a bad year, but that couldn’t be further from the truth as the company has experienced massive growth in the last couple of years. This 2020 Q4 EPS forecast is higher than the company’s actual reported 2019 4Q EPS of -$0.87. The Q4 report should be released around February 9th, 2021 and the expected forecast for the company looks to have an EPS of $-0.12. Q3 was also short by an even larger margin of 25% ($0.77 actual / $1.03 estimate) versus expected performance. Top line figures for Q3 were disappointing with the company falling short of expectations by 8% with 3.44 million dollars reported.ĮPS (Earnings Per Share) was a rollercoaster for Cleanspark with Q1 reports falling short of expectations by 24% ($0.87 actual / $1.14 estimate) and exceeding expectations by 7% ($1.13 actual / $1.06 estimate) in Q2. Revenues for the first two quarters showed the company exceeding expectations by 26% in Q1 (980K actual / 780K estimate) and 58% in Q2 (3.66M actual / 2.31M estimate). On paper, this CLSK share price rise in the last quarter was odd due to the company’s Q3 reports which showcased it underperforming in comparison to consensus estimates. was founded in 1987 and went public in 2016 after two successful acquisitions in prior years. Microgrids are primarily used for their capabilities to run “off-grid” in cases of high energy consumption on the main grid or power outages.īased in Utah, Cleanspark Inc.

The company achieves this aim through control technology solutions that help companies and municipalities manage energy storage and load separation between main power grids and established microgrids.

Cleanspark culper research software#

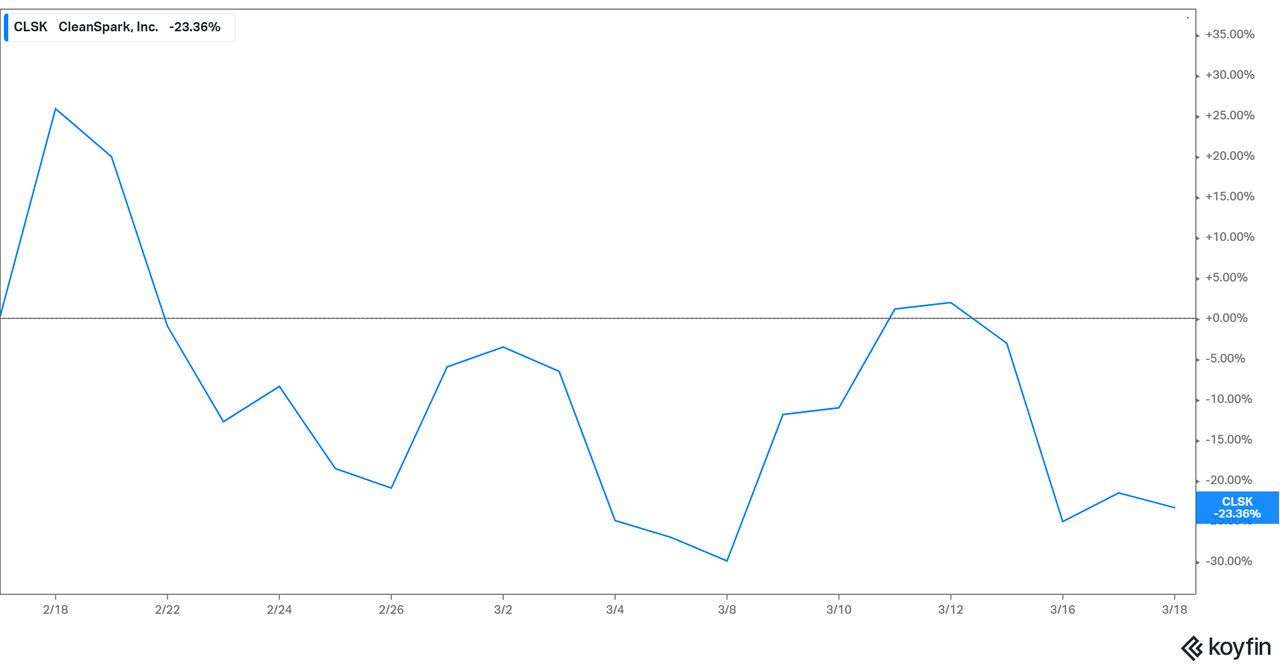

( NASDAQ:CLSK) is a provider of tools for distributed energy resource management systems and microgrids in the form of software controls. This press release may be considered Attorney Advertising in some jurisdictions under the applicable law and ethical rules.Cleanspark Inc. If you would like to discuss the complaint or our investigation, please contact us by emailing or by calling (646) 315-9003 You need not seek to become a lead plaintiff in order to share in any possible recovery. If you are a member of the proposed Class, you may move the court no later than Mato serve as a lead plaintiff for the purported class. is “another undisclosed related party transaction, as CleanSpark’s CFO Lori Love is found on p2k’s corporate documents since at least November 2018, well before joining CleanSpark and the p2k acquisition.” Further, the report alleges that “n effect, CleanSpark appears to have purchased the side business of its CFO, with zero relevance to the Company’s supposed clean energy mission.”įollowing this news, CleanSpark's stock price fell $3.63 per share, or 9.23%, to close at $35.71 per share on January 14, 2021. On January 14, 2021, Culper Research published a report entitled "Cleanspark (CLSK): Back to the Trash Can." According to the Culper Research report, “CleanSpark’s promotional charade has spanned marijuana, clean energy, “SaaS”, electric vehicles, and, most recently, bitcoin.”Īccording to the complaint, the Culper Research report claims that CleanSpark has "fabricated key elements of its business, including purported customers and contracts" and that the Company is also "rife with undisclosed related party transactions." For example, the Culper Research report alleges the entire February 2020 acquisition of p2k Labs, Inc.

A complaint has been filed on behalf of investors who purchased CleanSpark securities between Decemand Janu(the “Class Period”). (“CleanSpark” or the “Company”) (NASDAQ: CLSK). 19, 2021 (GLOBE NEWSWIRE) - Kaplan Fox & Kilsheimer LLP ( is investigating claims on behalf of investors of CleanSpark, Inc.

0 kommentar(er)

0 kommentar(er)